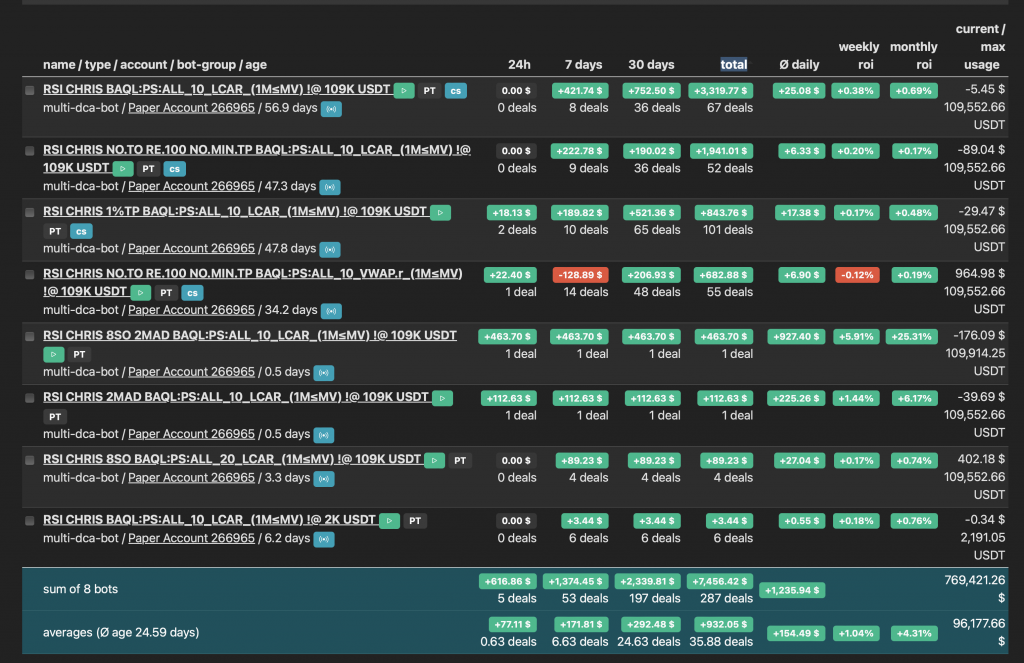

Two months ago I had the idea of running a simple but very interesting experiment a bot that enters and exits using only RSI and loads of safety orders using coins from bot assistant pair selection.

During this period I have tried many combinations including:

- alternative pair selection strategies: VWAP, VWMA, LCAR, etc

- using TP % for exit instead of RSI

- 3 day timeout and timeout disabled

- min TP% and no min TP% – to test if exiting a loss is better than holding a bag and waiting for timeout to kick in

I have to say that I’m impressed with the results and there’s tons of stats we can use as a baseline and improve based on how many safety orders were actually used, number of concurrent deals, deal average duration, and a lot more!

I don’t think I’d be able to cover everything but it’d be great if we can discuss more in detail in the next VIP workshop.

Statistics, links and early conclusions

RSI chris bot was implemented originally with 15 safety orders. The intention is to give as many chances to the bot to be able to close deals in profit.

But with 3 max active deals the bot quickly can get to a massive investment requirement of over 100K. The idea is to run this bot on futures. But in order to run this bot on futures we need to be 99.999% sure that most the majority of the time it can balance out losses with decent wins.

We saw in the past how this expectation was difficult to fulfil for bots like QFLO during the bear market and during the BTC season.

So far in the past 2 months you’d be glad to hear that while QFLO and many other bots running a wide arrange of coins got absolutely wrecked RSI Chris was able to hold printing green day by day. Small profits relatively to 100K but an average of 1% a month.

Before I lose you, let me provide some data that shows that this are fantastic results.

- Out of 3 max active deals, the bot only required 1 over 60% of the time, and 2 occasionally. 3 deals at the time was very rare.

- Only a couple of deals needed more than 7 safety orders.

All this data is gold.

I have created a few additional combinations base on those findings which started running yesterday:

- 2MAD – only 2 max active deals

- 8SO 2MAD – only 2 max active deals with 8 safety orders

- 8SO – 8 safety orders

I have the expectation (and hope) that these theoretically more efficient versions of the bot will outperform the original version

Min TP% vs NOT min TP%

It’s worth noting that I have mixed feelings with using the min TP% vs not using one. When setting a min TP% and the market is not dumping you can make more profits since you will be waiting until you are in profit to accept the signal to exit. The problem is when the market crashes: the one that doesn’t use a TP% will quickly try to exit at a decent loss and move on to new deals taking the lead for a few weeks.

Then the min TP% will eventually hit timeout and close at relatively larger losses, but then after that it will also take larger profits during the recovery phase which in the past two months ended up becoming the leader in terms of PNL with around 3% for the full period. That would have been 75% PNL using 25x leverage.