New VIP ORC signal: Bull and Bear OSC

Wait a minute. We already have so many ORC signals!

Exactly, but we need a new ORC signal that can control our bots based on the strength of the trend.

Trend tends to be interpret as a black and white thing: bullish or bearish.

But in fact the trend is a continuous and instead of just using the classic red and green SuperTrend we could use the “oscillator version” of SuperTrend to enter and exit based on the strength of the current trend.

For example, if you are using long bots you could enter when the trend is bullish and strong and exit whenever this is not true. Same with shorts bots which could be switched on when the trend is strongly bearish.

But we need to be careful! not everything is so simple: In a long downtrend like our current bear market a strong local uptrend won’t necessarily last very long, it will get sold very quickly. That’s true but that doesn’t mean we cannot use risk management to protect us from a false positive.

We are now releasing two separated ORC signals based on SuperTrend oscillator. BULLOSC and BEAROSC.

BULLOSC will send a BUY when the uptrend is strong and a SELL when it’s no longer strong or turns into bearish.

BEAROSC will send a BUY when the downtrend is strong and a SELL when it’s no longer strong or turns into bullish.

This following example in BAQL would start a bot when there’s a strong uptrend and stop it when it’s no longer strong:

BAQL:ORC:[BULLOSC:BUY_STT&SELL_STP]You can learn using the BAQL reference or directly use the BAQL tool to fill a form to automatically produce the BAQL code that fits your needs.

You can use Gavin’s DCA backtest v0.8.3 script to give these new ORC signals a go. Both versions of Gavin’s offer backtesting of BULL/BEAROSC.

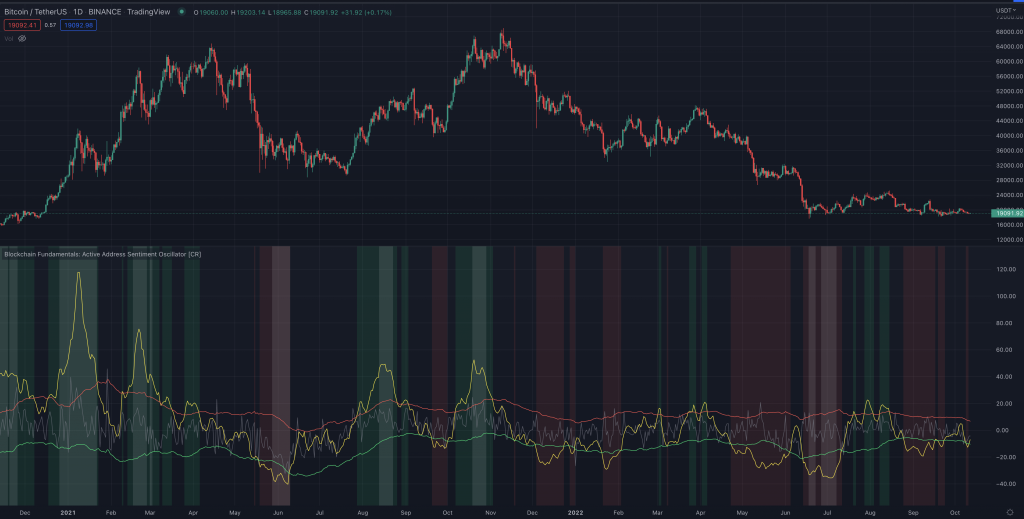

Be prepared for a challenge. If you compare the behaviour of 3 of our most used BTC ORC signals: ST vs STHA2H vs BULL/BEAROSC you will notice that OSC tends to have an active window much shorter than the older ones. It can trigger a buy early and anticipate a trend and in some cases turn into a false positive.

In the chart above the top section shows the signals from OSC. 2K is strong uptrend, 1K is weak uptrend, -2K is strong downtrend, -1K is weak downtrend. I recommend you copy the chart into your TradingView account to be able to have a closer look. Once you understand the main differences then you will be able to design your bots to better take advantage of it. Let me know if you want a video!

It can also exit earlier than the others since it will send a SELL once the trend is no longer strong.

This ORC signal is available to VIP and higher tiers. You can use NFT boosters to increase your allowances.

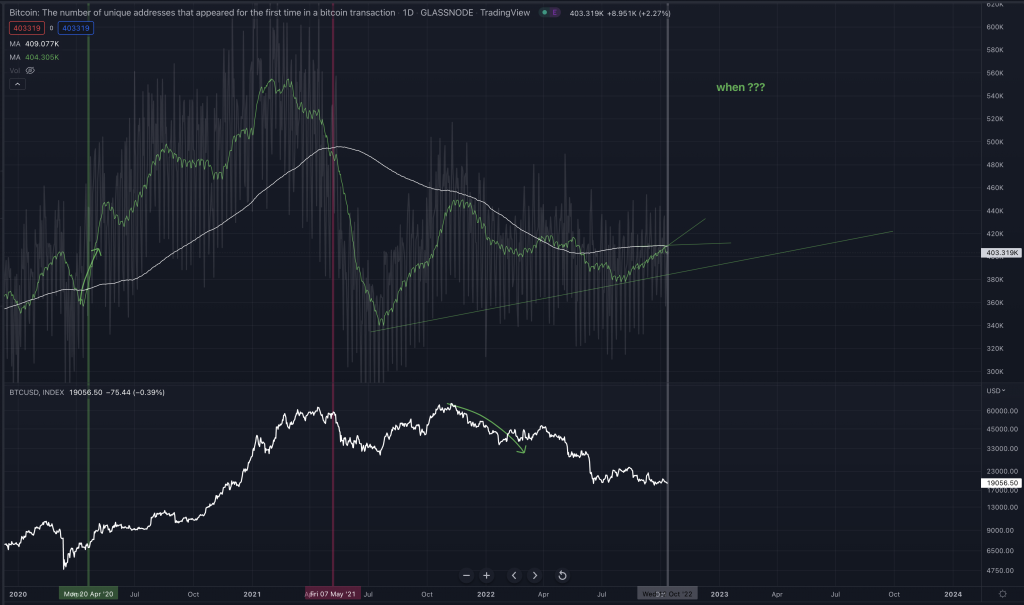

Number of unique addresses in first transaction is gaining momentum

The monthly MA seems ready to cross over the yearly which means that the BTC network is growing in number of new users in a similar way as it did in the past when getting closer to an end of the bear market. Careful, I’m not saying this is what I believe. I’m only saying what this chart says. IT might be right, it might be wrong. But we cannot ignore it.

From on chain data analysis we are in a strange place, almost every indicator out there is shouting capitulation is behind us or extremely close with no more head room for large downside moves.

The global fundamentals and macro economy is the most important counter argument that leaves the most experienced on-chain analysts still scratching their heads.

As mentioned multiple times. You have to look at the facts from a cold perspective. Holocaustic news could always get us to new lows and destroy any on-chain or TA argument to support an overdue capitulation. Everything looks horrible looking out the window. But it always has before looking better. No one said it was going to be easier! but then again, don’t get biased to only bearish because if history repeats this could also well be the bottom. At least most on-chain and TA supports that in the charts.

Pay attention to discord signals channel to become aware if and when see the 30 MA cross the yearly one, or make a copy of the chart and monitor it in real time if you prefer!

New On-chain sections added to the charts page

The charts section in our website contains a list of most of the charts used by TTP.

It now contains a separated section with On-chain data charts. Have a look!

Learn the goodies of using OKX with 3Commas

In this video I did my homework before considering OKX as a usable exchange.

It’s got pros and little cons and since the partnership with 3Commas it’s offering some pretty cool things including free trading.

In the recent days they also added futures DCA bots which is also cool.

- Try 3Commas and get free monthly access to trade on OKX!

- Register an account on OKX and get a 20% rebate! The first 50 signups who complete KYC (level 2) get a $100 cash back!

- Get all of the details about the OKX x 3Commas contest

New NFTs on sale

TradingParrots NFTs are designed to give the best of the community the holders. You can use them as boosters to increase your allowances. In a bull market I would expect the floor price to be pretty different to what we see these days.

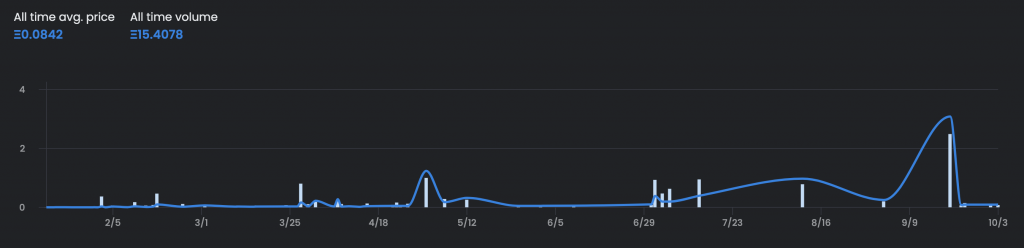

Sales of TradingParrots is coupled with the utility they offered and shows a divergence against what we currently see on OpenSea.

Volume on OpenSea is at an old time low but that’s not something unique to the NFT space.

It also affects crypto gaming and metaverse in general. Sandbox, Decentraland for example is now with less than one thousand daily users. I’m bullish in general in this industry and I expect it to have a strong and bigger come back. What we experienced in 2021 was probably only the beginning. The bear market is now cleaning and separating the good from the bad. The survival and evolution laws apply crypto just like they do in nature.