Tyson signal – Quant trading?

I’m trying out this Quant Trading bot which uses a very unique strategy that has been in used successfully in the stock exchange for years.

Quant trading analyses an enormous amount of data to forecast pumps.

It’s got a fairly low win rate but when there are wins they are BIG and compensate for all the smaller losses.

A very interesting approach that works with 3commas, FTX or Binance. All tokens.

I’m trying out on FTX with $1K. I’ll keep you updated on how it does in the next months.

We partnered with BlockResearch which means:

- Anyone gets 15% discount

- Observers get 30% discount

- Vip and higher get 45% discount

To be transparent when using the link I get a fee as well but I really wanted to make sure that members get a discount that is not available anywhere else.

New BAQL 1.2.1 and BotAssistant upgrade brings new parameters

We’re excited to announce BotAssistant 2.5 and BAQL 1.2.1 update.

Added CoinGecko as a second source of data for BAQL:PS.

Added three new sorting/filtering criteria (metrics) for BAQL:PS:

- WUSD: 7 days % change (USD). Similar to HUSD and DUSD but different timeframe

- MCR: Market Cap Rank. An ascending integer value from 1. The lower the value the larger the market cap

- CGR: CoinGecko Rank. An ascending integer value from 1 that changes sporadically, good for filtering

From now on LunarCrush will provide part of the sorting/filtering metrics and CoinGecko will provide the rest of the metrics. In more details:

- LCGS, LCAR, SV, BUS, BES metrics and the categories are provided by LunarCrush.

- DUSD, DBTC, HUSD, WUSD, CGR, MC, MCR, MV metrics are provided by CoinGecko.

In the cases where the data was available in both data providers the choice was made based on the accuracy and frequency of update of the data.

There’s no need to update the BAQL sentence of your bots.

Cerberus and DXY TA

What’s going on?

Cerberus hasn’t yet capitulated it’s still in the upper end threatening with a collapse in the price. We got a warning sell the last week. At the same time DXY is collapsing allowing all assets to run up like crazy horses.

Let’s have a look.

Cerberus

Cerberus is one of our signals you can learn more in this recent video. The indicator calculates the strength of the ratio between BTC and all stable coins to forecast how the money flows between them. As you can see below warning sells (top yellow labels) have been never EVER wrong so far in all BTC history.

I’m expecting to eventually see a red sell signal which would only trigger if price pulled back big. In fact I pay close attention to this indicator to assess risk and best opportunities to enter and still being on the top side of the signal makes me a bit itchy.

DXY weekly structure break

We are witnessing DXY showing some signs of breaking the weekly uptrend. We are for the first time outside the parabolic move and depending on how we close this weekly candle we could confirm it won’t be able to hold anymore and potentially opening the door for all risk-on assets to have a big bullish run.

In the chart below you can see the last Hive weekly SELL was triggered in September at around 109 and targeting 104. Hive can have drawdown and still play out, we have seen that behaviour in multiple occasions already.

The DXY weekly RSI just broke below the uptrend. BTC did something similar on the daily a week ago but it was a fake out. Breakouts can always fake out, it’s better practice to wait for confirmation: candle close next Sunday, turn support into resistance and then we are good to go.

In November the Fed can quickly revert things back into disaster zone in seconds just by increasing or even repeating the same rate hike of 75 bps. There are rumours of the Fed considering a reduction or even stoping the hikes. By the time that information is public expect the market would have already priced in the good news.

MACD is just confirming what RSI is already telling us. Bearish cross, histogram downtrend, first red candle, etc.

What am I expecting?

I still expect a lot of volatility in both directions. Even though there’s been 800 million liquidations there’s enough energy accumulated for a GOD size BTC candle which we haven’t seen in a long time. I’m personally seeing the risk too high to assume blindly it will all be to the upside from now and prefer as a conservative trader to wait for DXY confirmation and Cerberus to first flush from the top of the chart so it can print a BUY signal after reseting.

Bots with small max deviation of buy the top bots won’t be great obviously if we collapse now.

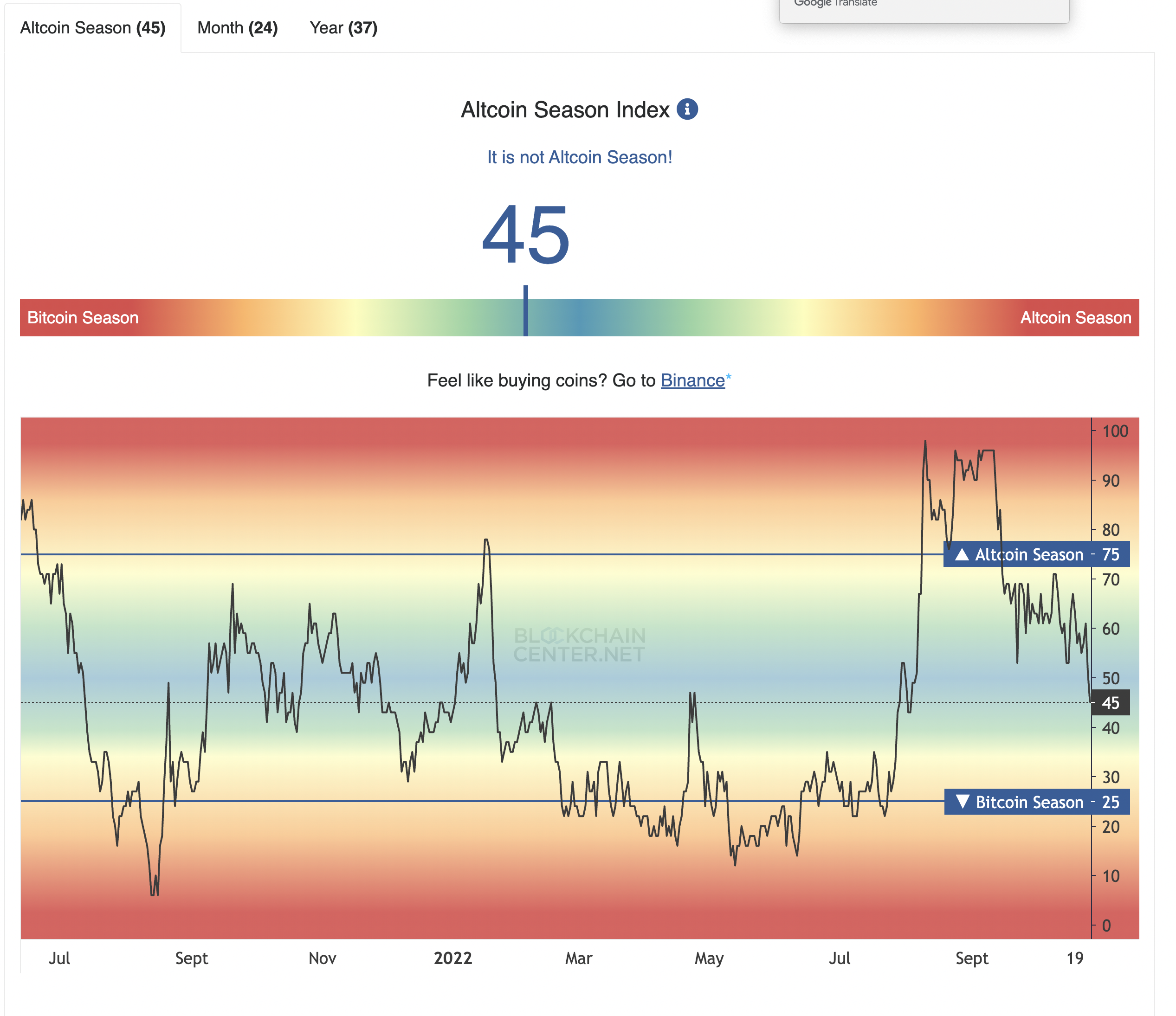

Altcoin season

Altcoin season index is coming down fast which means alts are suffering against BTC right now (coma, moonshot, serpil bots under water?). On Altcoin season index reset to below 30 or 30 for conservatives switching some more aggressive bots can be great. July to September was incredible. Their performance was outstanding but once it reached above 80 or 90, they started bleeding. We can’t time the market 100% accurately but even by only considering Cerberus, DXY and Altcoin index, can already make a a massive improvement on your bot long term profits.