In the past week I’ve seen some interesting developments with QFLO.

The table above is sorted by best performance in the past 7 days of QFLO 1.

Limiting the daily % and weekly % move of the coin to 20 and 50 respectively shows a 5x boost in performance. At least for the past week which is when this variation started. You can see that the original (second row from the top) today lost almost 500 and made a total of 211 for the week while the top row one, the ones using BA to filter out pumps has managed to make $1120 and make $200 today.

Interesting to see how BA pair selection can be used to dodge some extreme scenarios to our advantage.

Investment Answers fundamentals coin selection

I spend some time every now and then researching fundamentals of alt coins to stay informed of where I’d like to do my long term investment. My bear market accumulation.

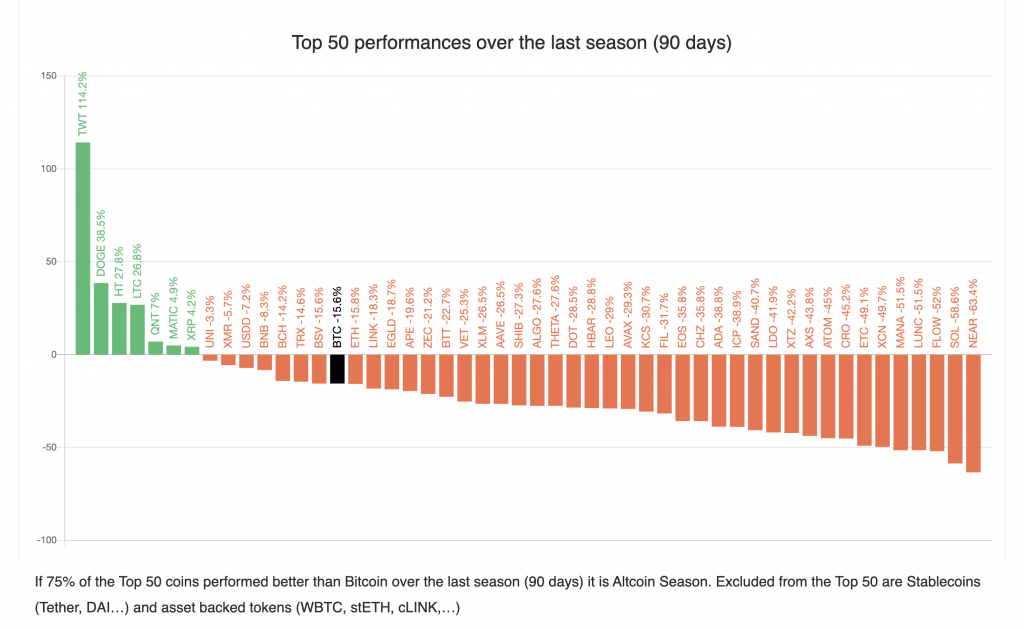

The ugly truth is that even though ALTs provide the largest upside they are subject to the very high risk and tend to dump way harder than BTC.

In order to make a great call for investing in ALTs its about multiple factors. But probably the most important ones are fundamentals, technicals and timing.

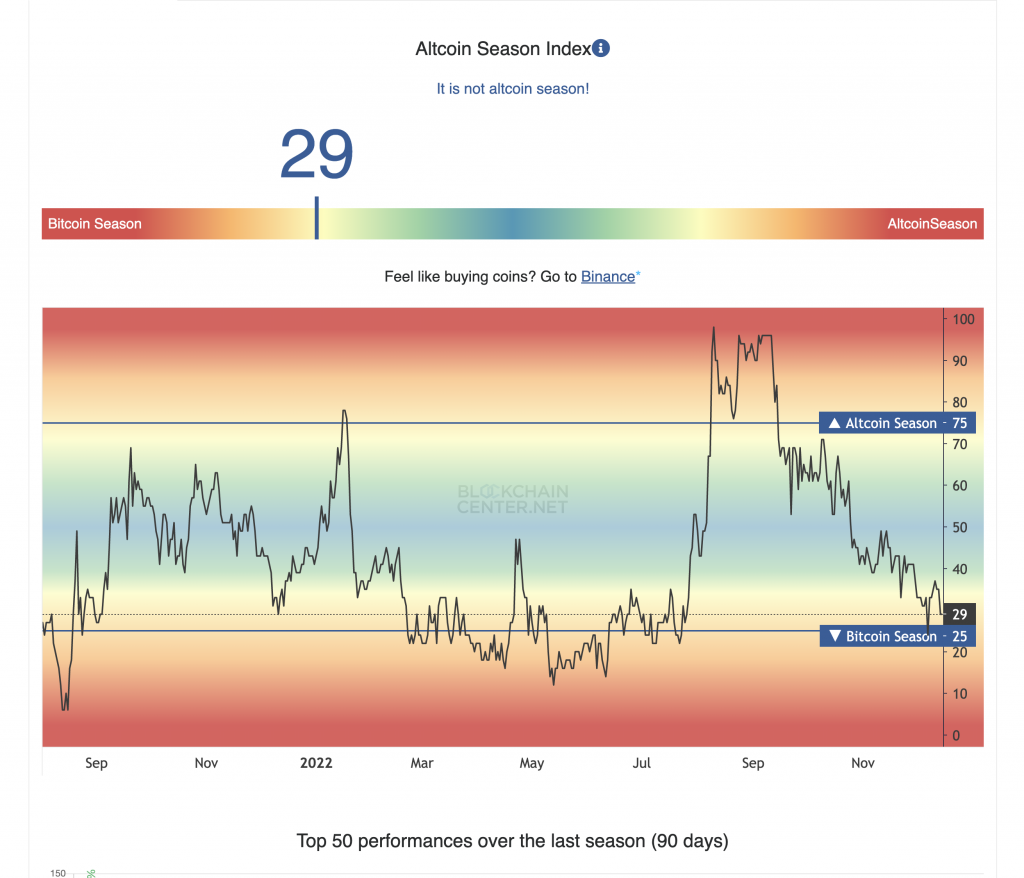

For timing I use many things but to keep it simple and short AltcoinSeason index and Cerberus.

Altcoin season

When the Altcoin season is showing that we are in BTC season which when we have values below 25, is when the ALTs in general are punished the most. If you keep an eye on this index, either using the chart, our discord signals channel or our shiny new ALT season ORC signal then you are in a much better first steps to time a better entry that most other impatient investors. Be aware that BTC season is an actual season, not because we go below 25 the day after ALTs will start pumping like crazy. A BTC season can last from a few weeks to even 6 moths or more.

Cerberus

Cerberus is an indicator that observes the flow of stable coins to all the coins in crypto.

It can very accurately predict when we are in a top and about to get a big pull back.

Cerberus won’t be able to tell you the precise day you should buy. Do not use the warning buy or buy signals to go all in. But there’s a big use for Cerberus for timing better my ALT entries: NEVER EVER buy when Cerberus is above 50 or when it’s on the way down. These areas are exactly when investors are dumping or about to start dumping on you. And the reason is very simple, most of the capital is already invested which means the likelihood of profit taking is very high.

I personally prefer to see a Cerberus reset, which is when its value hits the bottom. This event adds up to my confidence when used in conjunction with other sources of information. In other words I use it as a “do not long here” more than a “sweet spot finder”.

Coin picking

Picking coins with good fundamentals its a full time activity and I prefer to delegate it to multiple sources that have done consistently a great job picking winners while gathering and presenting the facts in an unbiased way. There are many channels I use to inform my self but one of my favourite ones is Investment Answers. Not a single channel will nail all the but seen a good percentage of decent ones is a green flag for me.

A recent stream from IA feature what would his portfolio look like if he had to invest 2K for a long term investment right now.

In the video he goes through each individual pick, fundamentals, risk, etc.

I resonate with around 70% of the choices and there are a few that were not under my radar that I find interesting as well.

I have taken the portfolio and breaking it down into 3 pots.

| pot name | coins | investment |

| top tier | ETH, BTC | 33% |

| middle tier | AR, BNB, FTM, MATIC, SOL | 33% |

| lower tier | AAVE, CRV, DOGE, DYDX, ENJ, GALA, GMX, GRT, IMX, INJ, LINK, NEAR, PYR, RNDR, RUNE, STG, UNI | 33% |

We can either wait for a BTC season and Cerberus reset to accumulate them or we can use conservative bots to accumulate them.

A combination of Composite DCA Martyn bot would work great as an accumulation method. Some of these coins might not actually end up profitable but as long as most of them end up having great fundamentals and we don’t enter any hard landing long term recession results should be great.

Martyn Take profits should accumulate but use take profit conditions that are way more ambitious. For example to sell when the 4 hour or daily RSI crosses below 70. If the token enters a decent rally you will eventually manage to take profits much closer to a local top.

A more slow and conservative alternative is to accumulate in areas where QFL triggers a buy. These signals typically trigger when there’s already a decent pull back.

The market doesn’t look ready to go heavy on accumulation yet but I personally wouldn’t wait either until the SEC pivots to enter. At that point prices would have already priced in the event and people will end up selling on news.

The intention of this article is for you to start thinking your accumulation strategy. Bear markets provide much better opportunities for those that have a little patience and long term vision.

Let me know what’s your accumulation plan going to look like!